This edition highlights important developments across multiple fronts: from the democratisation of private equity through innovative evergreen products to stark warnings from the insurance sector about climate risk to capitalism itself. We examine how established institutions like SE Ventures are adapting to support a new generation of climate tech entrepreneurs, while also showcasing transformative technologies like Paebbl's carbon capture innovation with their first demo plant in Rotterdam.

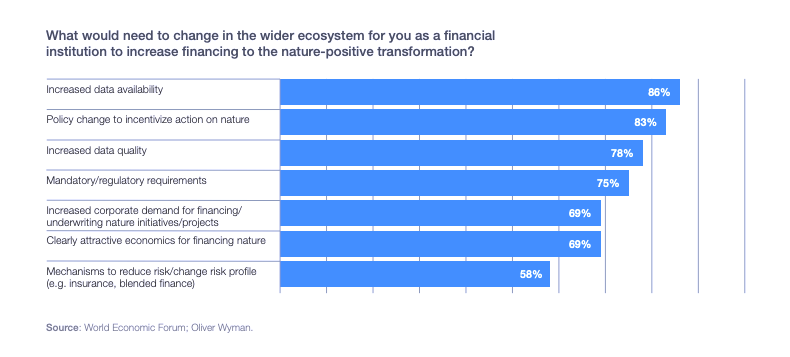

The featured graph from the World Economic Forum reveals a crucial insight, that the financial sector's transition toward nature-positive investing depends more on data quality and policy frameworks than on economic incentives alone.

We hope this curation will drive your own reflections and actions. Please feel free to share it with those who might be interested.

Let’s dive in! 💫

Insights

Sion Geschwindt 🇿🇦 shared how Paebbl, a startup turning CO2 into building materials, opens first demo plant in Rotterdam. This milestone demonstrates continuous CO2 mineralisation at scale, transforming captured carbon and olivine rock into a powder that can replace cement components, effectively turning buildings into carbon sinks. | The Next Web - CLIMATE - Technology

Bloomberg 🇺🇸 shared insights on how their data management group and sustainable finance data team are driving high-impact innovation together. Their collaborative approach focuses on making sustainable finance data more discoverable, accessible, and analysis-ready, meeting the growing demand for high-quality ESG metrics in an increasingly complex regulatory landscape. | Bloomberg - FINANCE - Data

Max Bearak, Rebecca Dzombak & Harry Stevens 🇺🇸 shed a light on Trump's stance on seabed mining regulations. The executive order circumvents international treaties to fast-track permits for mining valuable minerals in international waters, raising significant environmental concerns and potential diplomatic tensions with allies and rivals. | The New York Times - POLICY - Ocean Mining

David Bogoslaw 🇺🇸 tell us about a helping hand for a new kind of climate tech founder. SE Ventures' new accelerator program addresses the knowledge gap for tech entrepreneurs entering climate tech by offering industry expertise, customer connections, and $100,000 investments to help startups find product-market fit earlier. | Venture Capital Journal - CLIMATE - Investing

Kimo Paula 🇳🇱 shared valuable insights on how to grow a startup from zero to €1 million using AI tools. His comprehensive framework covers identifying demand, growing networks strategically, building MVPs efficiently, turning customers into advocates, and focusing resources on channels that deliver results. | LinkedIn - STARTUPS - Growth

Le Cercle des pionniers de la RSE 🇫🇷 tell us how sustainable businesses are profitable businesses. Their analysis demonstrates that durability is a strategic advantage rather than a constraint, with companies embracing sustainability seeing benefits in innovation, cost reduction, talent attraction, and investor appeal. | Les Echos - FINANCE - Sustainability

Damian Carrington 🇬🇧 shared Allianz insurer's warning that the climate crisis is on track to destroy capitalism. Günther Thallinger, board member at one of the world's largest insurers, explains how the financial sector may cease to function as regions become uninsurable and climate impacts exceed adaptation capacity. | The Guardian - FINANCE - Climate Risk

Marah Marshall 🇺🇸 shed a light on unlocking private equity through evergreen products opening doors to a new asset class. These innovative investment vehicles are democratising access with lower minimums, better liquidity options and simplified reporting for a broader range of investors. | EQT - FINANCE - Private Equity

Graph of the week

The graph that caught our attention this week comes from the World Economic Forum and Oliver Wyman's "Nature Positive" report. It reveals that financial institutions prioritise better data availability (85%) and policy changes (83%) over economic incentives (69%) to increase nature-positive financing. This insight is crucial as the private sector needs $1.2 trillion annually to reverse biodiversity loss by 2030.